华夏文明溯源之旅(历史人文深度游)

这条路线是经典中的经典,如果您是历史爱好者,希望深度感受中华文明的脉络,这是不二之选。

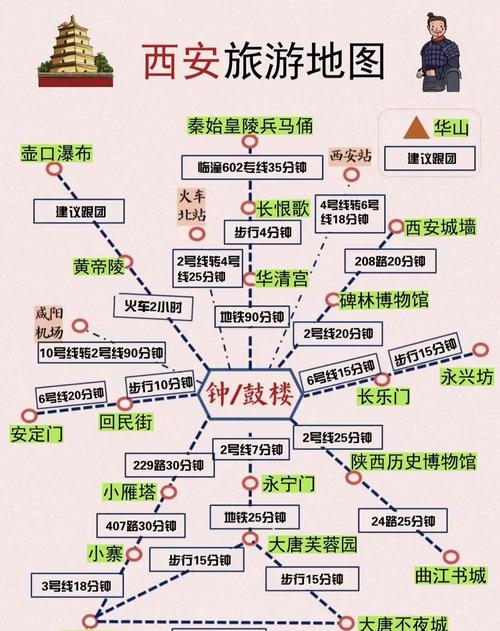

(图片来源网络,侵删)

- 主题: 秦汉雄风,盛唐气象

- 适合人群: 历史爱好者、文化探寻者、家庭亲子游

- 路程概览: 西安 → 临潼(兵马俑、华清池) → 乾陵 → 返回西安

- 总里程: 约400公里,路况极佳,全程高速。

详细行程:

Day 1: 西安 → 临潼 → 返回西安

- 上午 (9:00出发): 从西安市区出发,沿西临高速行驶约1小时抵达临潼区。

- 中午: 在临潼区品尝当地特色美食,如羊肉泡馍、biangbiang面、石榴汁。

- 下午: 游览秦始皇兵马俑博物馆(建议游玩3-4小时),这是世界第八大奇迹,绝对震撼,之后可以步行或乘车前往秦始皇陵(仅外观)。

- 傍晚: 游览华清宫(建议游玩2-3小时),这里是唐玄宗与杨贵妃的爱情故事发生地,也是“西安事变”的发生地,可以欣赏著名的《长恨歌》实景演出(需提前预订,夏季上演)。

- 晚上: 返回西安市区,可以去永兴坊品尝陕西各地小吃,或者逛回民街。

Day 2: 西安 → 乾陵 → 返回西安

- 上午 (9:00出发): 从西安出发,沿福银高速向西行驶约1.5小时抵达咸阳市乾县。

- 中午: 在乾县县城解决午餐,可以尝尝乾县有名的“四大件”宴席。

- 下午: 游览乾陵(建议游玩3-4小时),这是中国历史上唯一一座女皇帝武则天与唐高宗李治的合葬墓,山势雄伟,无字碑、六十一王宾像等看点极具历史价值,如果时间充裕,可以顺路参观旁边的永泰公主墓或章怀太子墓,感受唐代墓葬文化。

- 傍晚: 启程返回西安,车程约1.5小时。

Day 3: 西安市区深度游

- 上午: 游览陕西历史博物馆(需提前在官方公众号预约,周一闭馆),这里被誉为“古都明珠,华夏宝库”,馆藏极为丰富,是了解陕西乃至中国历史的最佳窗口。

- 下午: 登上西安明城墙,租一辆自行车骑行一圈,感受古城的脉搏,之后可以去钟楼或鼓楼俯瞰市中心景色。

- 晚上: 在回民街或洒金桥进行最后的美食探索,为旅程画上圆满句号。

行程亮点:

- 世界级文化遗产: 兵马俑、乾陵。

- 穿越时空的体验: 从秦朝的雄壮到唐朝的华美。

- 美食盛宴: 临潼、乾县、西安三地美食接力。

秦岭山水秘境之旅(自然风光休闲游)

这条路线让您逃离城市的喧嚣,投入大自然的怀抱,秦岭是中国的中央水塔,也是动植物的基因库,风光无限。

(图片来源网络,侵删)

- 主题: 森林、瀑布、峡谷、古镇

- 适合人群: 自然爱好者、摄影爱好者、寻求放松的游客

- 路程概览: 西安 → 太白山国家森林公园 → 朱雀国家森林公园/翠华山国家地质公园 → 返回西安

- 总里程: 约300-400公里(根据所选公园不同),山路较多,请谨慎驾驶。

详细行程(以太白山为例):

Day 1: 西安 → 太白山国家森林公园

- 上午 (8:00出发): 从西安出发,沿西宝高速转法汤高速,前往眉县的太白山国家森林公园,车程约2.5-3小时。

- 中午: 在山下的汤峪镇或公园游客中心附近用餐。

- 下午: 乘坐景区观光车进入公园,可选择两条线路:

- 北峰线路(经典): 乘坐缆车到天圆地方,感受秦岭主峰的壮丽,沿途有泼墨山、世外桃源等景点。

- 南峰线路(徒步): 挑战自我,徒步穿越红河谷,欣赏奇峰怪石和溪流瀑布。

- 晚上: 入住汤峪镇的温泉酒店,洗去一天的疲惫,享受天然温泉。

Day 2: 太白山 → 朱雀国家森林公园/青华山

- 上午: 如果精力充沛,可以去朱雀国家森林公园(与太白山方向不同,需导航),这里有奇特的冰川地貌和秀美的山水。

- 下午: 返回途中,可以探访一个古朴的村落,如涝峪河畔的村子,或者直接返回西安市区,在南门里或小南门感受西安的夜生活。

- 备选方案: 如果不想跑太远,第二天可以换成翠华山国家地质公园,以山崩奇观和碧湖著称,距离西安更近,车程约1.5小时。

Day 3: 西安市区或秦岭小环线

- 方案A (休闲): 在市区睡个懒觉,去大雁塔北广场看亚洲最大的音乐喷泉表演,逛逛大唐不夜城,感受盛唐文化。

- 方案B (深度): 进行一次秦岭小环线自驾,如环山一线1号公路,沿途经过王莽村、辋川溶洞、蓝田猿人遗址等,风景优美,适合慢行。

行程亮点:

- 天然氧吧: 呼吸最新鲜的空气。

- 地貌奇观: 山崩、峡谷、冰川、森林。

- 放松身心: 温泉、徒步、摄影,享受慢生活。

黄河文化风光之旅(壮丽山河体验游)

这条路线带您领略“母亲河”黄河的磅礴气势,感受黄土高原的苍茫与豪情。

(图片来源网络,侵删)

- 主题: 黄河风光,壶口瀑布,窑洞风情

- 适合人群: 摄影爱好者、想感受黄河文化的游客

- 路程概览: 西安 → 壶口瀑布 → 延安(宝塔山、杨家岭) → 返回西安

- 总里程: 约600公里,路程较远,一天驾驶时间较长。

详细行程:

Day 1: 西安 → 壶口瀑布 → 延安

- 上午 (7:00出发): 从西安出发,沿包茂高速向北,车程约4-5小时抵达宜川县壶口瀑布,建议早点出发,避开人流高峰。

- 中午: 在壶口镇或宜川县城用餐,可以尝尝陕北风味如洋芋擦擦、钱钱饭。

- 下午: 感受“黄河之水天上来”的震撼,近距离观赏壶口瀑布的壮观景象(注意安全,保管好相机),之后驱车前往延安,车程约2.5小时。

- 晚上: 入住延安市区,品尝地道的陕北菜,如炖羊肉、洋芋擦擦、油糕。

Day 2: 延安市区深度游

- 上午: 参观枣园革命旧址和杨家岭革命旧址,这里是中共中央旧址,感受红色革命历史。

- 下午: 登上宝塔山,俯瞰延安城全貌,宝塔已成为延安的象征,之后可以逛逛延安革命纪念馆,深入了解这段历史。

- 傍晚: 可以去延安新区,感受这座城市的现代与活力。

Day 3: 延安 → 返回西安

- 上午: 如果时间充裕,可以去乾坤湾(需绕路,车程约2小时),欣赏黄河S形大转弯的奇景,非常壮丽。

- 下午: 启程返回西安,车程约4-5小时,晚上回到西安,可以好好休息一下。

行程亮点:

- 世界第一大黄色瀑布: 壶口瀑布的雄浑气势。

- 红色革命圣地: 延安的红色记忆。

- 黄土高原风情: 感受独特的地貌和民俗文化。