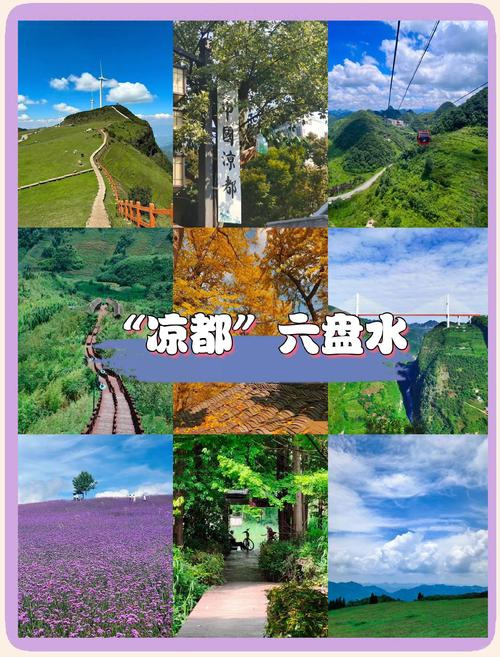

喀斯特地貌、高山草场、古镇风情和三线文化。

(图片来源网络,侵删)

下面我将沿途的景点分为三个区域,并附上推荐路线和行程建议,方便你规划。

核心路线:贵阳 → 安顺 → 六盘水

这是最主流、最便捷的路线,全程约300公里,车程约3.5-4小时,沿途的精华景点也集中在这条线上。

第一站:安顺市 (距离贵阳约1.5小时车程)

安顺是“贵州旅游第一站”,从贵阳出发,第一个值得停留的城市。

-

黄果树瀑布

(图片来源网络,侵删)

(图片来源网络,侵删)- 简介:亚洲第一大瀑布,贵州必游的“名片”,由黄果树大瀑布、天星桥、陡坡塘三个景区组成。

- 亮点:

- 黄果树大瀑布:感受“飞流直下三千尺”的磅礴气势,还可以走到瀑布后面的“水帘洞”,体验别样的视角。

- 天星桥景区:集石、水、树、洞、瀑、峰、田于一体,风景秀美,是《西游记》高老庄的取景地。

- 陡坡塘瀑布:是《西游记》片尾曲“你挑着担,我牵着马”的取景地,瀑布较宽,气势恢宏。

- 建议:黄果树景区非常大,至少需要安排一整天的时间游玩,如果时间紧张,可以选择性地游玩核心景区。

-

龙宫

- 简介:与黄果树同属一个旅游区,以溶洞、瀑布、峡谷、峰丛、绝壁、溪河、石林、漏斗、暗河等多种喀斯特地质地貌景观集于一身。

- 亮点:

- 一进龙宫,二进龙宫:乘船进入地下暗河,体验“一寸暗河一寸金”的神奇。

- 龙门飞瀑:中国最大的洞中瀑布,非常壮观。

- 旋水:一个可以自己控制旋转方向的奇特水池。

- 建议:如果时间充裕,可以将龙宫和黄果树安排在两天游玩。

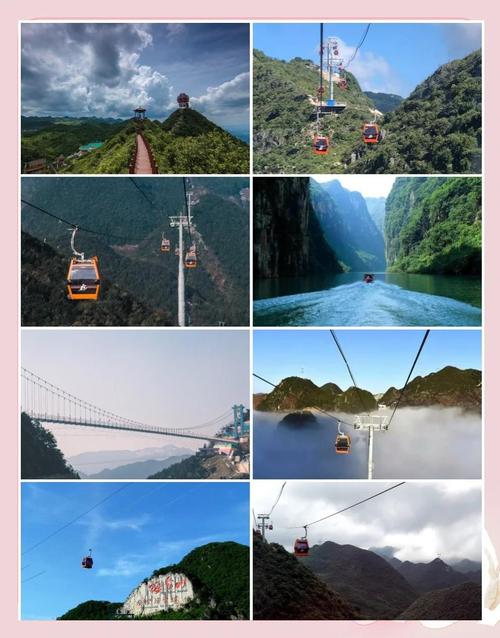

第二站:六盘水市 (距离安顺约2.5-3小时车程)

进入六盘水,地貌从喀斯特峰林逐渐转变为高山、草甸和乌蒙山脉的磅礴气势。

-

韭菜坪

- 简介:分为“大韭菜坪”和“小韭菜坪”,是贵州最高峰。

- 亮点:

- 大韭菜坪(海拔2900.6米):被称为“贵州屋脊”,每年8-9月,漫山遍野的野韭菜花盛开,形成一片紫色花海,非常壮观,花期是最佳游览时间。

- 小韭菜坪(海拔2757米):可以近距离欣赏成片的野韭菜花,徒步难度相对较小。

- 建议:山顶温差大,即使夏天也需要带外套,观赏韭菜花一定要在花期(8月中下旬至9月中上旬),其他时间景色相对普通。

-

乌蒙大草原

(图片来源网络,侵删)

(图片来源网络,侵删)- 简介:贵州面积最大的天然草场,位于盘州市境内。

- 亮点:

- 高原风光:一望无际的草原,点缀着风车,蓝天白云下非常惬意。

- 佛光:雨过天晴后,在特定位置有机会看到“佛光”奇观。

- 长海子:草原上的一个美丽湖泊,可以乘船、烧烤。

- 云海日出:是这里的一大看点,非常震撼。

- 建议:适合自驾或包车前往,可以在草原上露营,体验星空。

-

妥乐古银杏

- 简介:位于盘州市,是世界上古银杏生长密度最高、保存最完好的地方。

- 亮点:

- 金色世界:每年11月中旬到12月初,近3000株千年古银杏树叶变黄,整个村庄被金黄色的海洋覆盖,美不胜收。

- 古树与村落:古老的银杏树与黔西北特色的民居交相辉映,充满了诗意。

- 建议:最佳观赏期是11月下旬,需要提前预订住宿,这里也是摄影爱好者的天堂。

-

六盘水三线建设博物馆

- 简介:六盘水因“三线建设”而兴,这座城市的历史与“三线”紧密相连。

- 亮点:

- 历史记忆:通过大量的实物、图片和文献,生动再现了上世纪60年代国家在西南地区开展“三线建设”的火热岁月。

- 城市之魂:了解六盘水从“煤都”到“中国凉都”的转型历史,非常有意义。

- 建议:对历史感兴趣的游客一定不要错过,可以快速了解这座城市的文化内核。

行程规划建议

经典全景游 (3-4天)

这个方案适合时间充裕,想深度体验沿途风光的游客。

-

D1: 贵阳 → 黄果树瀑布 → 安顺

- 上午从贵阳出发,直奔黄果树瀑布。

- 下午游玩黄果树大瀑布和天星桥。

- 晚上入住安顺市区,品尝安顺小吃(如夺夺粉、裹卷)。

-

D2: 安顺 → 六盘水市区

- 上午从安顺出发,前往六盘水。

- 下午抵达后,游览六盘水三线建设博物馆,了解城市历史。

- 晚上可以在市区品尝水城羊肉粉、烙锅等地道美食。

-

D3: 六盘水 → 乌蒙大草原/韭菜坪

- 选择A (乌蒙大草原):全天在乌蒙大草原游玩,看草原、风车,体验骑马,晚上看日落星空。

- 选择B (韭菜坪):如果季节合适(8-9月),可以去韭菜坪看花海,感受“贵州屋脊”的雄伟。

- 晚上返回六盘水市区或住景区附近。

-

D4: 六盘水 → 贵阳

- 上午可以去妥乐古银杏(如果11-12月),或者在市区逛逛,购买一些特产。

- 下午从六盘水返回贵阳,结束愉快的旅程。

精华速览游 (2天)

这个方案适合时间紧张,只想看最核心景点的游客。

-

D1: 贵阳 → 黄果树瀑布 → 六盘水

- 早上早点从贵阳出发,争取9点前到达黄果树。

- 游玩黄果树大瀑布和陡坡塘瀑布(时间紧张可放弃天星桥)。

- 下午2-3点从黄果树出发,驱车前往六盘水(约3小时)。

- 晚上抵达六盘水,品尝美食,休息。

-

D2: 六盘水 → 乌蒙大草原 → 贵阳

- 上午前往乌蒙大草原,游玩2-3小时,感受高原草场风光。

- 中午从草原出发,返回贵阳。

- 下午抵达贵阳,结束行程。

旅行小贴士

-

最佳旅游时间:

- 春季(4-5月):气温适宜,山花烂漫。

- 夏季(6-8月):六盘水是“中国凉都”,夏季平均气温仅19℃,是绝佳的避暑胜地,但韭菜花期在8-9月。

- 秋季(10-11月):秋高气爽,是妥乐古银杏观赏的黄金季节。

- 冬季(12-2月):较冷,但可以看到雪景,别有一番风味。

-

交通方式:

- 自驾:最自由、最方便的方式,可以随时停车欣赏沿途风景,贵州山路多,注意安全。

- 高铁:贵阳到六盘水有高铁,非常快捷(约1.5小时),适合只想去六盘水市区及附近景区的游客,但去黄果树、乌蒙大草原等景点仍需转乘汽车或包车。

- 长途客车:贵阳客运东站有发往六盘水各地的班车,但耗时较长,不如自驾和高铁方便。

-

美食推荐:

- 安顺:夺夺粉、裹卷、破酥包、安顺裹卷。

- 六盘水:水城羊肉粉、烙锅、酸汤鱼、盘州火腿、洋芋粑。

希望这份详细的攻略能帮助你更好地规划贵阳到六盘水的旅程,祝你旅途愉快!